ISSUE 12: CHINA 2023:

What Happens Next?

Please note all content is personal opinion only. However, as one may tell I am changing my views on what is happening on China daily. I am not even sure if I am pro or anti COVID zero.

1993 was the year I moved to Shanghai. Back then Shanghai looked like not much had happened since liberation. The plane landed at the very modest Hongqiao airport – I cannot remember how I managed to get to the university but remember how alien everything felt. Life was tough – people dreamt of the three wheels – a bike, a washing machine (don’t ask me why that was considered a wheel) and a sewing machine (yeah I know … weird). Someone with RMB 10,000 in the bank was considered fabulously wealthy. I started working as a lawyer part time (many would say a habit that continues to this day). Most projects back then were joint ventures or rep offices. Many companies were coming to China intoxicated on the China opportunity … some had opportunity forced upon them - many clients in the 1990s were suppliers to the big automotive companies. The major concerns for foreign companies back then were dealing with Chinese authorities, dealing with your Chinese partner, protecting your IP, finding skilled staff, keeping your expat management under control. So not much has changed.

30 years is a generation but in China it has been a lifetime. As a result many companies set up in the 1990s and 2000s are now long overdue for adjustment. COVID and geopolitics are forcing many companies to consider questions that they have conveniently put on the back burner.

China in 2023 will be very different from the China of 1993 – many JVs and WFOEs are nearing the end of their initial terms. No-one could have predicted in 1993 how China would be 30 years later. Accordingly, as COVID recedes international businesses will need to tussle with difficult questions that have likely been put on ice for a few years. Do we renew our JV? Do we re-negotiate it? Is our China operation too small or is too big? Are we still located in the right place? Do we need to share risk with a Chinese partner? Do we need to empower the local management?

Brave Guesses

My guess (and only a guess) is that in the next few years:

BIG MNCs Double Down - Large international companies will continue to invest and expand in China. They will not decrease stakes in JVs but actually seek to increase their holdings. These large companies have the resources to be successful in China. Also, China is just too large to ignore – also it is not just China – Southeast Asia, Central Asia, Africa will also all follow in growth. The world is becoming less US-Euro centric. The major corporations know this. In some sensitive sectors the big companies may be forced to pick sides but in the main business will go on. They will still find ways in which to be in both the West and the East.

SMEs Look to Lower Risk - Medium and smaller international companies may seek to de-risk in respect of China. I do not expect many companies to fully up sticks and quit but as China euphoria subsides tougher questions come to the fore. Do we have excess capacity in our China operations? Do we feel comfortable operating our company? Are our suppliers resilient? This week a client discussed that they have a factory operating at 5% capacity. Another client has had all their expats flee and they do not feel like they know what is going on – some of these companies are considering joint ventures or Chinese management taking a stake to manage the operations more dynamically. Better to share the risk than try to remotely control an operation from Munich.

China is getting stricter – 30 years ago a major complaint of foreign investors was the lack of regulation. Today few make this complaint. Authorities are clamping down more. There is an array of rules on data compliance and consumer protection - all make life more difficult for corporates. Personally, I think it is not a matter of Chinese authorities targeting foreign companies. Indeed, most ire has been directed at private Chinese companies, but they are often more adept at navigating the regulatory minefields. They are for sure much better at keep any grievances private. The days where foreign invested companies could get away by crying a bit and writing a self-criticism is so 1990s.

China is getting more protectionist – few would claim China has ever provided a level playing field … but this may not be new. Local procurement rules favor local companies or JVs. There is a push for indigenous technology. However, to be fair Western governments and media have not been shy in promoting reshoring, friend-shoring (although I thought the US only has interests not friends), excluding Chinese companies from their markets etc. So, it seems a little churlish for Western companies to cry crocodile tears about exclusion. China has been doing this for a long time – I accept that this does not make it right. Regardless, protectionism makes it more difficult for foreign invested companies to compete in the China market. Last month a long-term expat manager was telling me he was trying to convince his HQ that it would be sensible to introduce a strategic minority local partner as a protective measure. In the past I would have thought this to be overly dramatic – today it may be a sensible step.

Ugly Economy, Ugly World – few expected a worldwide pandemic, a Russian invasion of the Ukraine, double digit inflation – if you did, then send over your lottery numbers!

These global issues also impact China and globalization. As possibly the biggest beneficiary of globalization and reversal is also damaging for China.

A US client last week shared their concerns in relation to their main Chinese supplier – geopolitics is a consideration but not the main one. The main concern is the resilience of the Chinese supplier as they expanded their factory. The Chinese supplier made promises to the local government in relation to jobs and taxes (remember those promises? Sometimes they come back to bite). The Chinese supplier is trying to shed employees and feeling pressure on all sides – employees, investors, landlord and the government. As previously discussed, moving away from a main supplier is not as easy as flicking a switch. The relationship is often interdependent. A lot of international businesses will be nervous about the performance of their businesses, their customers and their suppliers in 2023. But to be fair the whole world is looking bad so moving a factory to Mexico or Vietnam may not solve anything but rather increase risk.

China has changed, My JV/WFOE not so much – 30 years ago I was young, optimistic and energetic. Three decades can wear you down. Also, your circumstances change. We worked on the construction of the Shanghai New International Exhibition Center – I was sent out to take photos of the site (not sure why). I remember that there was nothing to be seen in any direction (admittedly pollution made it a little harder to see far). Today it looks like downtown and is rumored to be moved out. Many factories face relocation pressures as residential areas expand, and manufacturing is forced to purpose built industrial zones. Environmental conditions have become far stricter resulting in FIEs being forced out and sometimes closed down.

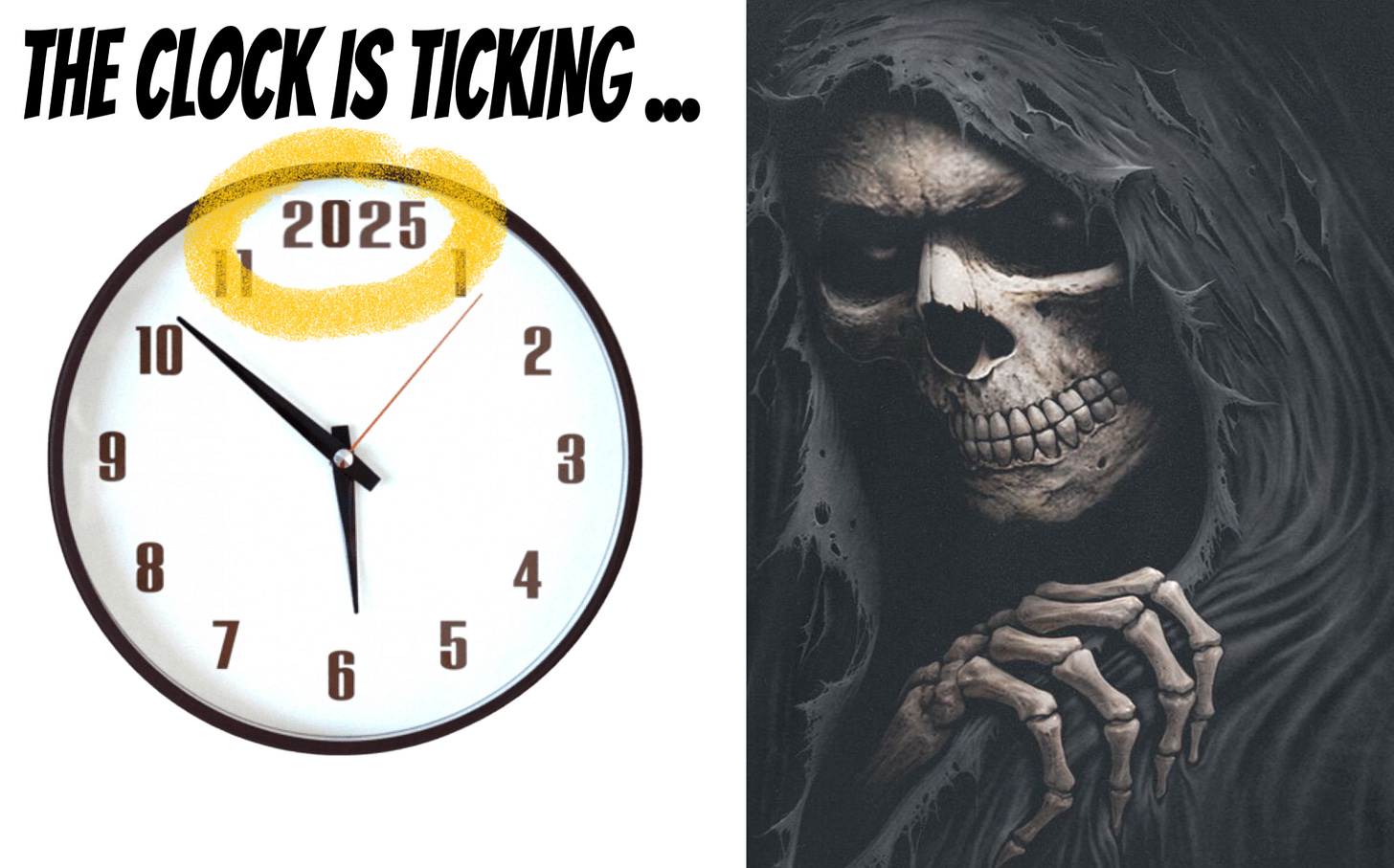

The Clock is Clicking for Joint Ventures – The PRC Foreign Investment Law came into effect on January 1, 2020 contains a time bomb for joint ventures (ok a bit overly dramatic but bear with me). One of its provisions abolishes the differences between Sino-foreign joint ventures and other types of PRC companies – primarily in respect of their governing structures (i.e. move to a shareholder meeting, board of directors and management). The law provides a five-year transition period for existing JVs so January 1, 2025 is D-Day.

Many may think that this is just simple paper shuffling – change the joint venture contract and articles of association. They may be right but normally life is much more complex. In addition to the mandatory changes the law also allows joint venture partners to agree to more flexibility on governance. All long term joint ventures have issues - opening up the joint venture contract will also open up a Pandora box of issues that have built up over decades.

Life has Moved On – 1993 was really so long ago. Back then Jiang Zemin was PRC president, Bill Clinton US president. The European Economic Community created the single market. Ukraine had recently become independent of the Soviet Union. Inflation in USA was under 3%. China’s annual GDP per head was USD377. People in Shanghai would ask foreigners if they like their own country or China better.

So, a lot has changed.

Things have probably changed in your JV or China business.

Has the market changed? Is the business still profitable? Has local competition become stronger? Does the current business model still meet market requirements? Has the business been impacted by practical changes? This is often in respect of procurement. Is the old way of doing business still the right way to do business? Are the contractual arrangements which are in place still fit for purpose? What are the real risks of 2023? Has the management changed? There must have been management changes. Worse still have there been no management changes?

How is your JV partner? Still looking healthy? Many successful SME JVs are based on a foreign and a Chinese entrepreneur forging a business together. Often outside of first tier cities. Wanting the best for their children a lot of these Chinese entrepreneurs sent them to Harvard or Oxford. These children also wanting the best for themselves are often unwilling to return to rural or industrial Sichuan or Liaoning province. Even if they return is this second generation tough enough and knowledgeable enough to run the business. They often have a less than perfect knowledge – in one case the founder’s son who showed us around the factory got lost and had to phone someone to find us. US and European family-owned businesses bring in family members or professional management early on – China often not so much. These kids may be more interested in trust funds than widgets.

Next Issue: Option 1: Downsize or Exit?

In the last few years, we have had over 20 foreign invested enterprises consider exiting China. However, only 6 liquidated at the end of the day. Most kept a toe or even a foot in the China market or they sold their China business to someone else – sometimes paying to do so. So next week’s newsletter will be looking at the kind of problems, unrealistic expectations that the depressed often have when looking to exit China.

European Tour

Having faced down COVID and as the European summer holidays (very slowly by Chinese standards) recede I am now ready to meet old contacts and make new friends.

I will be visiting with some colleagues to discuss all things China on:

Munich – 13 to 15 September – to avoid the Oktoberfest which starts on 17th

Berlin - 21- 23 September

Would be great to catch up with old or new friends – so drop me a line at mark.schaub@eu.kwm.com if you have time for a coffee

Till next week,