Issue 27: The China Tariff Shock: Decoupling or Freefall?

There were a few days in early April where I turned on the news and did not see Donald Trump dominating. This time is now well and truly over – with his new tariffs then no tariffs then bigger tariffs and then pausing for everyone except China Donald Trump has once again truly monopolized the attention of the world. From farmers in Cambodia to auto component suppliers in Canada to penguins in the Pacific almost no one (other than Putin and Kim Jong Un – a somewhat unlikely pair to enjoy American mercy) have been left unscathed.

China, as always, is front and centre in the mind of the US president when it comes to trade.

Based on what I am seeing in China the initial takeaways are as follows:

What Does China Think?

At least in my circle there were many Chinese previously positive about President Trump and very few who showed antipathy. A few months ago, people would say Trump was a “businessman”, “transactional”, “will do a deal with China”. Nowadays most seem to think he is reckless.

There appears to be very little appetite for backing down. Most Chinese believe that both sides will lose but the Americans will lose more – more BIGGLY.

Why is this?

Little Interest on Chinese Part to Give in - The Vietnamese may offer zero tariffs but what are they going to buy from the USA? Virgin fish sauce from Oregon? China has a much more complex trading relationship with the USA. Also much of the exports from places like Cambodia and Vietnam are in reality Chinese in origin. The Chinese factories decamped part of their production years ago to such countries. In some cases, the local content is limited to threading the laces in shoes. Accordingly, it is very much in doubt that the USA will truly find much solace in having zero tariffs with Vietnam as this will not address the main motivator behind the tariffs – the US trade imbalance. Such compromises are likely only helpful if they can be used as coverage by a certain political figure to proclaim victory in the trade war and then dial back what seems to be an ill-conceived endeavour. China on the other hand has reduced its reliance on USA as a market (also this is further reduced if lower tariffs are applied in countries like Vietnam, Mexico and Cambodia where China has outsourced some production). Also China mostly buys agricultural products, grains, fuels and oils, high tech products and machinery from the USA – except for high tech there are many other potential suppliers. The USA buys … basically everything from China – so expect a mix of inflation and shortages.

Also, how will American consumers feel – just coming out of a cost-of-living crisis and then being hit with this self-imposed bout of sanctions.

Which quote resonates more about today’s US consumer “Americans have more stuff than anyone else in the world, and yet they are still shopping” James Kunstler, social critic or “The greatness of a nation lies not in its riches, but in the character of its people — willing to suffer together, rise together, and sacrifice together” Abraham Lincoln.

China has other Choke Holds - In addition, to reciprocal tariffs China is placing export controls on critical minerals where China enjoys a chokehold. Indeed, some commentators have said this proves Trump’s point that reliance on China is a major vulnerability. This may be true, but it may have been better for the USA to wean itself off such dependency before launching a trade war and going cold turkey on critical products. It is difficult to believe they did not realize this would be a countermeasure as China has regularly used its rare earth capability as leverage in the past.

Further the Chinese government has many other potential countermeasures such as sanctioning specific USA companies; imposing a digital tax on US companies such as Apple or even ignoring USA IP rights (which I doubt – but would be quite funny to behold – so many of the products made in China earn a pittance for the Chinese factory who does the heavy lifting and the economic benefits is almost exclusively enjoyed by the USA brand owner).

What do US Companies Procuring in China Think:

If the Chinese people are remaining stoic the USA importers who are active in China are not. They are livid. They are scared. They are pissed off.

Contracts not Magical - In most cases the tariffs are borne by the importer (the factory does not want to keep tabs on various tariffs, customs duty or VAT or other charges levied overseas). These US importers are now looking at their contract and in the vast majority of cases not finding anything that will reassure them.

Negotiations will be Tough - Some will try negotiating with their suppliers to share the tariff burden or lower prices – maybe possible at 20% but at 125%? Contrary to what President Trump has been saying corporate America were not “suckers”. Prices were negotiated hard and Chinese factory margins are normally razor thin – even with the best good will in the world it will not be possible to find fat in the margins of the Chinese factories to cover these costs. In most cases there is no legal exit as tariffs are unlikely to be considered either force majeure (unforeseeable, unavoidable, and insurmountable objective circumstances) or frustration of the contract (due to unforeseen changes the contract is no longer fair or cannot be fulfilled). President Trump spent much of his campaign talking about tariffs and indeed that it is the most beautiful word in the English language – so their imposition cannot really be said to be “unforeseeable”. Possibly 125% could be argued as being unforeseeable but this is likely difficult. Also, who will have time to litigate?

Move Production? To Where? - For some of these companies the tariffs will be a terminable blow. It would take at least a year to reshore production of most products (much longer for many others) and Trump’s hit everyone strategy means that near shoring is also risky. Global supply chains are incredibly complex and interwoven – how to deal with the constant flow of goods across borders and utilisation of expertise borne of decades of production know-how. For many US companies there is no alternative to their Chinese supplier – that is not a typo – not suppliers – many US companies are unhealthily hitched to a single Chinese supplier. These companies will face incredible challenges – possibly unachievable ones – many may not remain in business. The more discretionary the spending the more at risk the US importer will be – fashion and furniture more at risk than hygiene and medical supplies.

Cutting Costs in China - US companies are also immediately making plans to shut down or lay off employees in their China operations. Such layoffs are not simple. Mass layoffs are complicated under Chinese law so it is likely that most US companies will need to negotiate terms with their employees. This is always more difficult in economic turbulent times. Most companies are looking to reduce head count by 1) Mutual separation – most likely – but needs the employer to offer a little more severance and is subject to employee’s consent; or 2) unilateral termination based on “significant change on objective circumstance” but this has onerous procedural requirements; or 3) “economic lay-off”- but this requires filing with local labor administration – and this can be a pain and not all companies will fulfill the requirements. Some entities are considering a “time-out” for their staff until (if) things become clearer. If the employer decides to announce a work suspension, then the employees will not be required to work and from the second month, the employer can pay only the minimum wage until the end of the suspension period. If everything goes back to normal, then the employer can ask everyone to return to work. As the situation is febrile this would avoid the disaster of terminating most staff; paying them severance and then rehiring them if President Trump announces a new best deal of the century (which I expect will be the outcome – it is too complicated to just forcibly decouple overnight – in addition where will the workers for this manufacturing come from? America is also deporting illegal immigrants en masse).

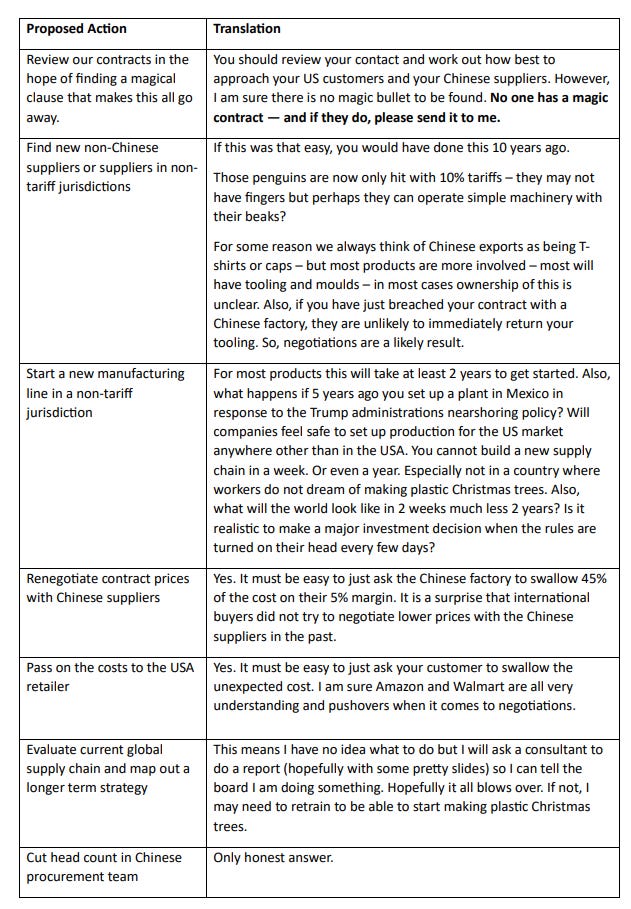

So, what is an International Company with Business in China to Do?

The management of international business (especially USA ones) that buy or assembles or produces in China needs to be seen as taking action ... at least some action. Even if it is very difficult to know what to do right now and it is all happening very quickly. I have set out below a list of common actions being taken alongside a translation of what action really means:

Possible Outcomes

Probably More that Trolling - Optimists hope that the tariffs are some form of next level trolling or extremely aggressive opening gambit for trade negotiations. Personally, I think it is unlikely. President Trump has been obsessed with tariffs for decades and although almost all economists agree the result will be extremely negative the world we live in means that this message may not get out. In any such seismic economic change there will be winners and losers – there may be many more losers, but the media will seek to establish a level playing field of pro- and con- Tarif commentators. This is also the case for Brexit – I am sure the impact of Brexit was likely 90% negative for the economy, but this message is too complicated to get across. Indeed, even when Trump seemed to reverse his long held policy of 2 weeks and suspend tariffs on everyone except China there was a deluge of US business leaders and politicians feting him as the “master negotiator” and “expert of the art of the deal”. It is a puzzle what was so masterful about doing a 180-degree reversal once the bond market soured.

Trading Around America – although it is the biggest economy it is no longer the only game in town. A few years ago, China thought as Australia’s major customer it would be able to use its buying power to intimidate Australia. Australia’s response was to successfully look for other markets. China and others will probably do the same to the USA. Where it is important to sell to the USA they will likely need to manufacture there. This is a bit like the strategy some clients had for “Made in China for China”. At the time these international companies said such a strategy was necessary to address geopolitical concerns about a country that was capricious, did not follow the rules and did not treat trading partners fairly. Sounds familiar?

Conclusion

Wars begin when you will, but they do not end when you please.

Machiavelli

If globalization is a luxury sports car, we have gone from hurtling along merrily since the 1980s; slowing down a bit in the aftermath of Covid and now accelerating full tilt in reverse off a cliff. It is unlikely to end well.

Barring a shameless climbdown and proclaiming of victory it is likely that business and the world will be entering a messy time. Consumers who have endured a cost-of-living crisis now face even greater inflation and less choice. US companies will face great challenges as there supply chains snap or fail to seamlessly align. Some will falter. Some will buy indulgences from the US administration in a manner akin to the Catholic Church in the Middle Ages. A practice so open to abuse it led to Luther kicking off the Protestant reformation. Most will try to muddle through and do the best they can.

Chinese factories will not find anyone to indulge them – they will need to find new customers, new ways of doing business, and put up with a lot of crying from American customers. No doubt there will be pain for the Chinese economy and Chinese factories, but they are likely to be more stoic.

For businesses trading with China you will need to review your contracts; see how your supply chain pieces together; negotiate as best you can for a solution with your Chinese partners; consider how best to deal with staff if China is no longer viable – all while realizing this will be a challenging time for everyone.

We will be doing a webinar on this topic with special guests (not President Trump):

Date:

Tuesday, April 22, 2025

Time:

9:00 -10:00 (London Time)

10:00-11:00 (Central European time)

17:00 -18:00 (Beijing Time)

20:00 -21:00 (Sydney Time)

Language:

English

Register Link:

Contacts:

Gracie Yu yujianxian@cn.kwm.com

Hope to see you there!

Mark Schaub