ISSUE 3: BALANCING HQ OVERSIGHT VS LOCAL DYNAMIC MANAGEMENT

Please note all content is personal opinion only. This does not reflect the opinion of my employer or indeed anyone else. Indeed, it may not even reflect my opinion later today.

FIEs means Foreign Invested Enterprises (i.e. joint ventures and wholly foreign owned enterprises).

Keeping control or delegating greater power to local management? This has been a major dilemma for international business in China for decades. Often this has been couched in terms of localization (i.e. mainland Chinese managers replacing expatriates). However, localizing decision making is an issue for every in-country manager regardless of nationality or ethnicity. Can a business react to difficulties or seize opportunities if every decision needs to be blessed up a long of chain of command? Or do international businesses expose themselves to too much risk if they cede too much control?

As always when a lawyer is involved the answer is …. It depends.

This issue has become all the more relevant due to COVID’s impact on China and international travel. One could say China has not really been encouraging foreign travel during the COVID era. Since March 2020 it has been almost impossible foreigners to enter China.

For foreign invested businesses in China this travel embargo has led to 1) HQ having very little real insight (some may say unkindly “even less real insight”) to what is happening on the ground; 2) HQ and China operations become increasingly remote as a steady decline of expatriates with no replenishment has taken place. This also leads to a loss of global firm culture and interaction between HQ and China; and 3) personnel changes at the HQ level often mean the Chinese employees do not really know anyone at HQ anymore.

As with many issues COVID is confronting people with questions they should have been asking years ago:

Can I manage a market as dynamic, massive and ever changing as China remotely from Europe or the USA?

Is it safe for me to entrust greater decision-making authority to my China team?

How do I balance oversight against agility/efficiency?

How do I lose weight while eating junk food and drinking too much wine during lockdown?*

When will I start living the life I have always wanted to live?*

*These questions will be addressed in a different issue entitled “Learning to Love Yourself During and After Lockdown: A Lawyer’s Guide”.

Thirty years ago, China was for most foreign companies a lucrative niche market with great potential but of limited sophistication. Today for many of these foreign companies China is a critical market that is increasingly complicated, regulated and above all, competitive. Thirty years ago, foreign business interaction with China was often simply sourcing or manufacturing for export or B2B (e.g. auto suppliers for VW, selling to China manufacturing etc.).

Back in those days there were many challenges – unclear regulations, IP protection, increasing labour costs, real estate issues etc. Today, I imagine for almost every business in China the number one challenge is COMPETITION – competition for market share, for talent, for opportunities.

While there will be risks, perhaps sourcing companies or B2B businesses can still be remotely managed to a large degree but this is far more difficult for consumer facing businesses or larger businesses.

Today’s China requires greater agility than in the 1990s – management needs to respond to competition, regulatory change and market trends – to be fair it has probably been sub-optimal for a decade to remotely micro-manage China operations from the USA or Europe. The impact of COVID could mean a business limping along sub-optimally may not survive.

In China, anything good will be snapped up quickly.

One client, a retailer of homeware, very successful internationally, attractive product range, homeware was a hot sector, product was competitively priced… what could go wrong? Well for one thing … real estate could go very wrong and they had a bricks and mortar model. Securing leases was crucial to the business but the European HQ was wary of perceived risks in doing business in China.

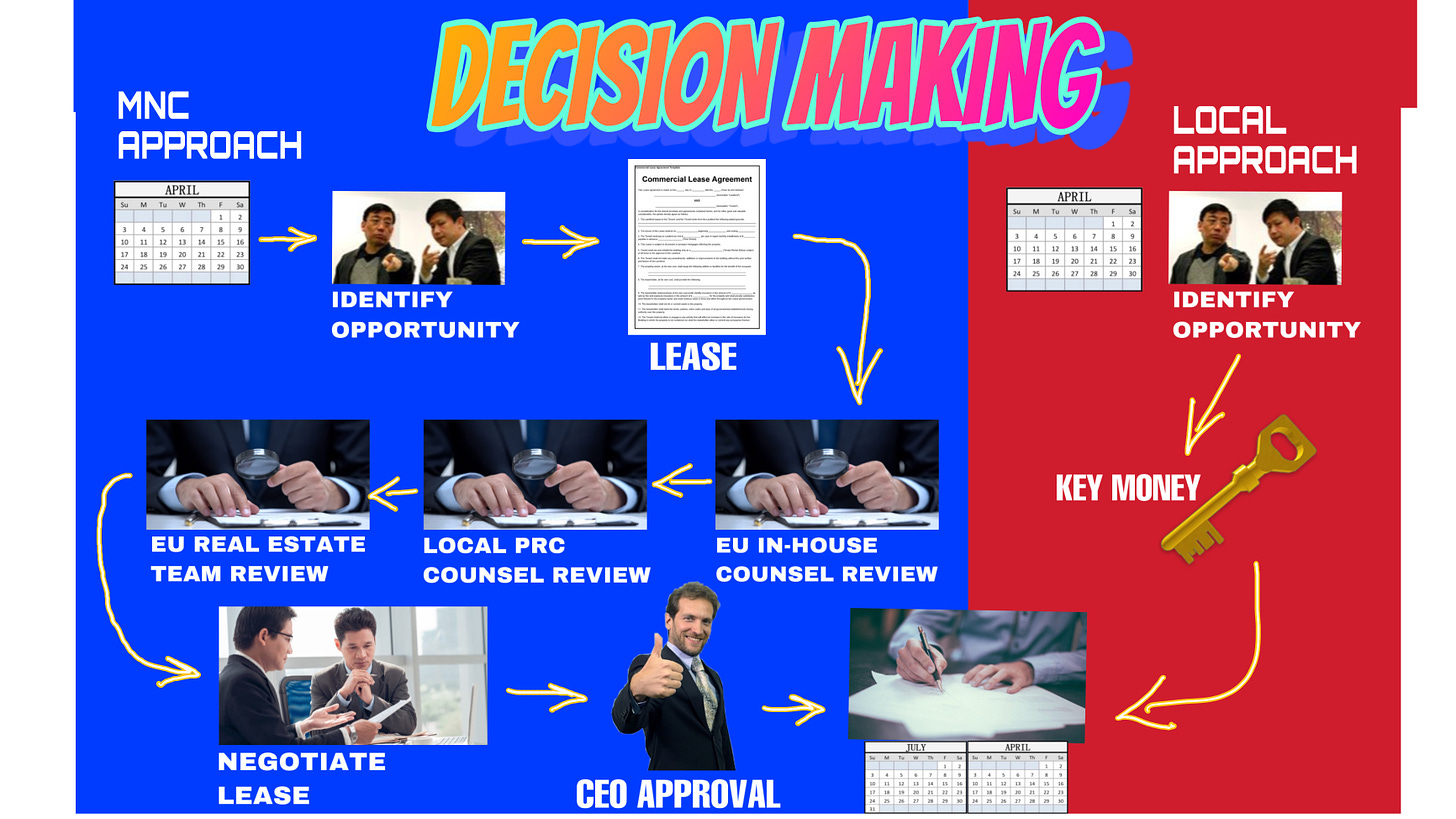

To combat this the European management came up with a very well thought out protocol to be followed when entering into a lease as illustrated below:

The HQ protocol was excellent at minimizing risk – in large part this was due to almost no leases being signed. Only the most desperate of landlords would have the patience to wait for the whole laborious and time-consuming process to unfold. Most leases were for basement space in non-performing malls. This killed the business in China.

On the other hand, the preferred Chinese approach was 1) have a look, 2) pay key money and 3) sign lease. Problems would be ironed out later. For one client the Chinese approach had the diametrically opposite result of the Western protocol – the client was swimming in leases as the real estate team’s main KPI was number of leases signed.

In addition, local management (Chinese and expat alike) are often exasperated by being second guessed on what are perceived to be minor decisions. This frustration has increased as there is no longer any face-to-face interaction and a feeling that “no one understands or cares”. And maybe they are right.

NEXT ISSUE: THE PROBLEMS WITH HIGHLY AUTONOMOUS LOCAL MANAGEMENT

Clearly, if local management in China cannot react swiftly to challenges on the ground can be damaging. However, sometimes when local management has too little oversight then the results are not only damaging but also entertaining. In the next issue I will give my experiences why HQs often have difficulties dealing with their local teams and suggest some solutions. No really. Maybe.

SCIENTIFIC STUDY NEEDS YOUR HELP

There has been little scientific research in the area of localized management in China. To address this an ongoing survey is looking at common pain points in how European business managing their local Chinese operations. If you are a senior manager in a European MNC’s Chinese operations please participate in this survey (this can be done anonymously): https://survey.zohopublic.com.cn/zs/CCDDCZ?s=mark

Participants will receive a copy of the results – so what are you waiting for?

WHAT TO READ THIS WEEK

As this newsletter goes out on Tuesdays we will not know if all the articles about Shanghai re-opening on June 1st will prove to be true – most articles do not state the year so an element of mystery remains.

June 1st SHANGHAI RE-OPENING

In last week I have been free to roam the streets of Huangpu. Not much/anything is open. But this weekend saw a major uptick in people walking around and drinking take away coffees but unlike Anfu Lu scenes people were behaving responsibly. The police did not seem interested in moving people along and also let them sit at cafes outside. Also saw cleaning take place at Starbucks and McDonalds. Even saw a couple flag down a taxi. Seems likely that a major loosening is in the offing. Wish us all luck!

Shanghai Planning to Return to Normal 1 June - Reuters

Shanghai Business to Resume on June 1 - NHK

Unreasonable Curbs Lifted - VOA

CLOSING

As always very happy to hear people’s views or comments. Stay well. If you are in Shanghai hope to see you for a drink Wednesday!

Till next week,