ISSUE 8: THE END OF MADE IN CHINA? NAH.

Please note all content is personal opinion only. This does not reflect the opinion of my employer or indeed anyone else. I don’t even read this.

Coming Webinar - Last Thursday the scary sounding Cyberspace Administration of China released its draft “Regulations on Standard Contract for Cross-border Transmission of Personal Information” – this addresses one of the main concerns of Western business in relation to data – how can we transfer China sourced personal data offshore? Well wonder no more! We are holding a free webinar this Friday to discuss the new draft and next steps – I will be joined by people who actually understand the topic. Hope to see you there! Please register at:

Coming Live Event in London – As we no longer fear COVID we are holding a live event at 6pm 12 July at our offices to talk about my recent experiences in Shanghai’s lockdown – free food and drinks – what more could you want? Please register by emailing Megan Gu at megan.gu@eu.kwm.com.

THE END OF MADE IN CHINA? NAH.

There has been a lot of discussion about China’s role in global supply chains. Many (often by lawyers or consultants dealing in China who feel dejected) have been predicting that Western companies will be departing China and cutting China out of their global supply chains. Their reasoning includes 1) geo-politics makes investing in China or trading with China less palatable; 2) COVID has awoken Western governments to the dangers of over-reliance upon one supplier (especially if that one supplier is China); and 3) Western consumer backlash due to human rights concerns.

My answer is “Don’t think so”.

Reason 1: The Past

For at least 15 years there have been regular reports from some elements of the media in respect of an expected wave of “onshoring” and of moving supply chains closer to their home markets. Back in 2007 a journalist Sara Bongiorni wrote a whole book on trying to live for a year in the US without buying any products made in China. Hers was less a political quest and more just to see if this was possible. It does, however, serve to show that the “China is making everything” concern is not new.

Despite all of this I have seen little evidence in my own practice of Western companies ceasing to source from China. A notable exception is certain clothing that seems to have moved largely to Bangladesh. However, this seems not to have been due to human rights concerns or the strategic importance of Western consumers being able to buy a cheap T-shirt … or rather it is no doubt due in no small part to the strategic importance of Western consumers being able to buy quality products on the cheap. Most of us have an in-built prejudice that exports are unallayed goods whereas imports are a sign of weakness. Rarely do we consider how the importing public has benefitted from trade with China – in the world of 2022 are most consumers worried about East-West geo-political issues or inflation.

We always think this time will be different - COVID lockdowns and a single ship blocking the Suez canal all illustrated how incredibly complex global supply chains could come a cropper in a manner beyond anyone’s control. However, perhaps the better lesson is how quickly logistics can overcome temporary disruptions and how clever they are to work around problems. Even at the height of the Shanghai lockdown workers beavered away in closed loop environments to keep the port open and avoid massive supply chain disruption.

COVID raised media and government awareness (at least for a time) of their reliance upon China for critical goods. This is highlighted in a report by the British think tank Civitas including pharmaceuticals, medical devices, bandages, gloves and PPE. What was more surprising that despite constant warnings about China reliance the report finds that the amount of medical goods sourced from China had increased by 300% since 2019. Some of this was likely due to COVID related testing kits and PPE but this does go against the argument that governments are “onshoring” production.

In most media, there is little sympathy for an alternative viewpoint, namely that China is a dependable supplier that has increased access to quality products for a better price to average consumers. The NHS is continually cash strapped and it is unthinkable that any government would need to make cuts in service in order to move supply away from China to more “patriotic” suppliers. It should also be remembered the UK government spent £37 billion (yes I double checked the figure with the UK Parliament Public Accounts Committee) for a home grown app that never worked.

Reason 2: Populism deals Poorly with Complexity

In some ways the debate about China reminds me of the Brexit debate.

No doubt there are arguments on both sides of this issue. The problem is that populists often fail to consider the complexities of big issues and are dishonest as to the costs.

China has been a major part of the global supply chain since 1990s. The UK joined the forerunner of the European Union in 1973. In both cases the economies and supply chains became increasingly enmeshed. Regardless of one’s view of Brexit it appears that increased complexity has led to a marked decrease in trade between EU and the UK (i.e. UK exports to the EU dropped 23% and imports by 25%). Further, Brexit may be a major cause why Britain has higher inflation than its EU peer economies. Indeed, the barriers to trade are so difficult to navigate that the UK has still not started checking EU products entering the UK.

Brexit shows that global and regional supply chains are complicated, intertwined systems built over time that cannot be turned off overnight and can have far reaching and unexpected consequences.

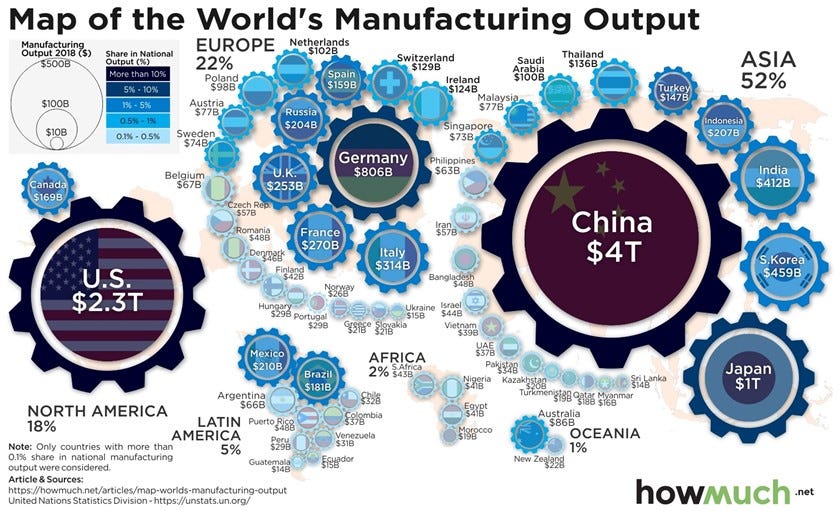

The UK is largely a service-based economy, so the disruption of Brexit is still relatively muted – imagine trying to cope with China being shut out – China which exports USD 3 billion worth of stuff every single day. China’s manufacturing output is valued at USD 4 trillion (USA is USD 2.3 trillion and Japan’s USD 1 trillion). Size and manufacturing muscle matters.

China is not an autarkic workshop. Products made in China typically have components imported from all over the world for assembly. It is difficult to see how 40 years of built-up relations and ecosystems could be cast aside as argued by populists.

Reason 3: Unexpected Damage from Disruption

The Russian invasion of Ukraine is a humanitarian disaster. However, from a disruption perspective it illustrates the unintended consequences of major events. Russia (world’s 11th largest economy just ahead of Australia) that John McCain once described as “a gas station masquerading as a country” has shown that being a major supplier gives you a lot of clout. The customer is not always right ...

The Ukraine is the world’s 53rd largest economy but its current troubles have led to worldwide shortages of sunflower oil and grain. It may even trigger famine across Africa.

These are countries that have a limited level of involvement with the world’s economy – what would the consequences be if the West tried to move away from the world’s biggest manufacturer and exporter? Some may argue that this makes the case for moving manufacturing out of China and on-shoring production back home. But I do not think this is possible … China makes just too much stuff. There will be efforts to have some critical manufacturing within a nation’s border or with allies but these will be very limited. They may even have Chinese companies as owners.

Reason 4: The Fat Smoker and Human Nature

David Maister’s book “The Fat Smoker” considers how difficult it is to do what you know is good for you in the long-run because you have to deal with lots of temptations in the short term. His book seeks to support managers and companies to fight these temptations.

I feel human nature is such that it bends to temptation. Needless to say, there are many fat smokers in procurement departments.

How brave would a CEO need to be to say: “I do not care if this costs 20% more and the supplier is untested – I am moving these orders pronto.”

Who could but marvel at the courage of a CEO who says “I don’t care about shareholders – I am going to do what is right for Uncle Sam”.

For most people hedonism beats idealism most of the time. In our careers we are often only at a company for the short term and if we take risks to shareholder value for the greater good then this may be a very short … short term.

Reason 5: Risk is Higher than Expected – Sometimes the Chicken does not Cross the Road

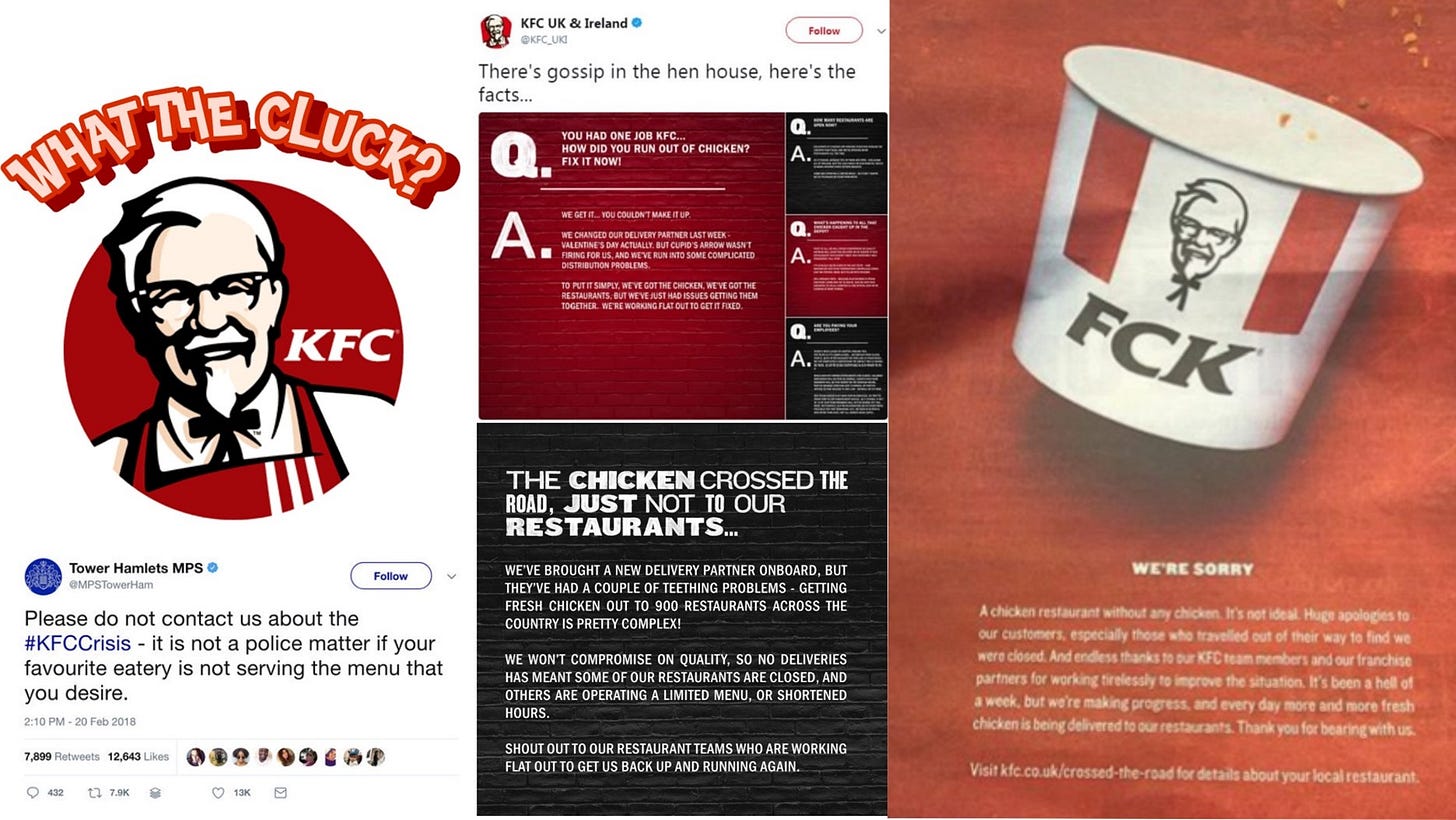

Perhaps the story that best illustrates the dangers of trying untested, new ideas in respect of supply chains involves a chicken.

In 2018 KFC in the UK decided to award its distribution contract to DHL in order to realize promised cost savings. The almost immediate result was that 80% of KFC UK’s branches were closed. KFC had both restaurants and chicken – but were unable to bring the two together. As always, the public was understanding … the police had to ask the public to stop complaining to them about KFC’s lack of chicken. Imagine how the public would react if there was no availability of China manufactured products and/or prices soared due to government policy.

Despite the above I think it is likely that some production in the global supply chain will move away from China – just not massively.

The main reasons for this trend will be:

Increased China cost – back in the 1990s China was a low-cost manufacturing workshop for export. However, increasing costs means that there are cheaper options available – such as Bangladesh for textiles. Perhaps the best indicator of this increase in cost is the number of Chinese companies themselves which are setting up manufacturing sites in cheaper parts of Asia (such as Myanmar or Cambodia) and in Africa.

Western Businesses were too Bullish on China – many Western manufacturers established too much capacity in China back in the 1990s and 2000s – it is unlikely that they will completely leave the market but it would make sense to downsize their footprint in China. In this regard several Fat Smokers at HQ have kept many of these manufacturing plants alive in a zombie like fashion. Closing a plant in China was considered too much work or the Chinese partner too difficult to work with.

However, sometimes Fat Smokers embark on new diet fads. COVID has made international business re-think everything. Unlikely to be much new thinking but likely that long put off plans may now be realized. The fat smokers may finally take steps to slim down their China manufacturing footprint to a more appropriate level.

Downsize, Sell or JV in Supply Chain - However, the above pull out is unlikely to be abrupt. In some cases, Western business will consolidate their existing China manufacturing capacity, they may seek to de-risk their position by selling the operations to Chinese suppliers or by restructuring the company as a JV. Many Western companies have come to realize that local management can run manufacturing operations more efficiently than they can – no need to own the plant to own the business.

Business can be Local – one reason I am not fully convinced that Western business will move most of their manufacturing to a Vietnam or a Cambodia is that many of the possible geo-political issues they face would not stop at China’s border. Accordingly, a more regional approach going forward may be attractive especially as manufacturing becomes increasingly automated and governments around the world more generous with their subsidies. We have one USA client that wants to set up the second manufacturing plant for their product in the USA to be quicker to market. Almost all their product is made by one Chinese supplier. Their idea is to have this Chinese supplier JV with them in the USA to bring his operational and plant expertise to the USA. There will be more of this – Chinese companies will also be assembling or manufacturing closer to their destination markets.

Next Issue: The Main Problems with Supply Contracts

It has always been a mystery to me that people spend USD 100,000 to set up a WFOE but with reckless abandon enter into multi-million dollar supply contracts which essentially bet the farm without any adult supervision. Next issue we will discuss how companies need to approach their supply chain including DD on suppliers, why compliance is likely to become ever more complicated, contractual terms, dealing with disputes and common scams.

See you next week,

Great article! It would be interesting to estimate the total costs of cutting out China of the supply chains. Not only for UK/NHS - but for the EU and our overall level of welfare. Perhaps it would be wise to make a back-of-the-envelope calculation before any future boycott is considered... And then we should also keep in mind that alternative sourcing markets such as Bangladesh and India have their own challenges in regards to workers rights, etc.

Agree to your point "China is a dependable supplier that has increased access to quality products for a better price to average consumers." Looking forward to your next article.